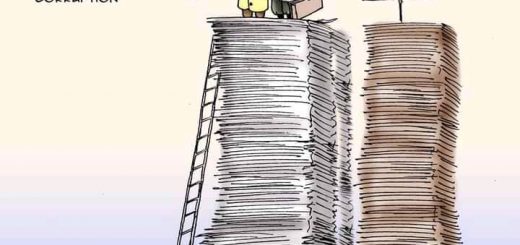

The Corruption Adjustment Tax in Uganda that will help future generations recover plundered public resources in Uganda

Every year more than twenty trillion shillings are plundered by public officers in Uganda. For forty years public officers have plundered trillions of tax payers money thus illicitly enriching themselves and their families. The glorious and expensive sky scrappers, factories, farms, hotels and extravagant homes littering Uganda are built, bought and paid for by stolen public resources. Public properties are sold in deals made in the wee hours of the night to powerful and connected nominees and figure heads. For four decades the thieves have thrived and gotten fat on the back of poor Ugandans who are stuck in poverty. Oppressed, hungry and hopeless.

The adage goes that even the best dancer must leave the stage. Inevitably the crooks and thieves will one-day cause their own downfall or the poor will overthrow the greedy overlords. When that reckoning arrives it becomes necessary to recover the plundered public resources. So the question becomes how best to recover all the loot. Some argue that we should expropriate all the looted property but the question becomes how do we identify it and separate it from law abiding citizens. How do we overcome the right against compulsory acquisition of property without compesation and the dangerous consequences of expropriation of property without compesation. The Zimbabwe example counsels against following in their footsteps. Others argue that we should trace and recovery all the plundered resources one after another but the question is how do we fund such a laborious and expensive exercise and how do we prevent its inevitable compromise by the thieves and crooks. How do we overcome the tribalism accusations that will arise because the beneficiaries of the loot are concentrated mainly in a few tribes.

I am a proponent of a Corruption Adjustment Tax to help future generations recover plundered public resources in Uganda. A progressive tax that eliminates the discretion of the enforcers and applies to the weak and powerful alike avoids expropriation of property without compesation, avoids the accusations of tribalism and is wide enough to catch most of the crooks and thieves. A tax is capable of catching the heavyweights and strongmen such as the first family, military leaders and all conceivable thieves. A tax will catch those skilled at hiding their loot and those that have successfully cleaned and laundered their illicitly acquired property.

Read More

- Parody of Robert Kasibante v Kaguta Museveni Tibihaburwa and the Electoral Commission, Election Petition 01 of 2026.

- Ideal Amendments that should be included in the Magistrates Courts Amendment Bill 2026 of Uganda

- President Yoweri Kaguta Tibihaburwa Museveni is a minority President voted by only 7,946,772 (36.7%) out of 21,649,608 eligible Ugandan voters in the 2026 Presidential Elections

- Four years of IGG Beti Kamya drowned the Inspectorate of Government (IG) deeper into oblivion and irrelevancy but it Can be redeemed

- The Proposal to Make Magistrates Grade Ones Chief Magistrates is an efficient use of resources that will improve service delivery in Uganda